The Hidden Reason Gold Stocks are Weaker than Gold and a New Discovery in Economic Theory

by Kenneth J. Gerbino

July 2011

In 2008, a horrible financial and economic contraction occurred that destroyed asset values, bankrupted financial institutions, had devastating effects on real estate and sent the world banking system into a tailspin.

This was a liquidity crisis. Since then, I have been thinking through the illogical and difficult concept of; how could there be a liquidity crisis when so much money had been printed beforehand? With money and credit available in abundance how could a liquidity problem even be possible? One would think that the more money the more liquidity. What was wrong with this picture? After a lot of thought, I have found the answer.

In the twenty years leading up to the 2008 U.S. crisis, the U.S. money supply (M1) increased by 87% and the M2 money supply by 171%. By any past standards these were huge increases in money supply. In Europe the monetary expansion was even more, with M1 increasing by 145% in only 10 years leading up to 2008. The great western world industrial countries were awash in cash, money, credit and liquidity. So how could a liquidity crisis materialize and asset values plummet almost everywhere?

The answer to this puzzle is actually a new economic theory; a discovery that I am naming The Gerbino Principle of Liquidity.

I have figured out the reason why more money can actually lead to less liquidity — not more — in a modern fiat paper money economy! I have named this new economic discovery, some may say, in an egotistical manner for two reasons; 1) I want to make sure that the source of this new economic principle is known — after all someone has to claim authorship, and 2) If anyone wants to refute it they will know who to go to.

This new theory has overwhelming importance to anyone who owns investments at this time, especially stocks, because the panic of 2008 is going to repeat again and possibly soon for reasons I will discuss later.

A liquidity crisis is not the credit cycle or a credit crisis, a business slowdown, a boom and bust economic cycle, a recession, or the business cycle. I will explain the differences of these events later in this text.

This Economic Principle or Law is something very different and never before explained by the philosopher/economists of the past or present.

Below is the Gerbino Principle and the explanation and logic behind this new economic discovery.

The Gerbino Principle of Liquidity

- Liquidity is eventually destroyed, not created by increases of fiat money.

- A financial liquidity crisis will always follow a prolonged period of fiat money creation.

- The more “paper” money printed or created by fiat the more severe the liquidity crisis will be.

- Future “offsets” * to the created fiat money supply could also create a liquidity crisis.

* Offset is a term used by central banks when they sell treasury securities to dealers (specific banks). As the dealers are required to pay for the securities they are sending money to the central bank. When these funds arrive at the central bank they have been taken out of the U.S. money supply. This money is now deducted from money in circulation. This is an offset. They have offset a past increase in the money supply. It is hard to believe that modern man would allow bureaucrats to not only create money out of thin air but to then have the authority to destroy it.

A liquidity crisis is when there is not enough money to satisfy the orderly liquidation of financial or real assets without creating a massive destruction of those asset values.

In simple terms: The Gerbino Principle is: The more fiat money the less financial liquidity.

A liquidity crisis is caused by too much money being created in an economy, not too little money. This is explained below.

A liquidity crisis is not a credit crisis. A credit crisis is a problem of solvency not liquidity. A credit crisis is when lenders are not lending to weak businesses, institutions or governments because of risk aversion. A credit crisis could start a liquidity crisis as assets are sold to meet short term insolvency problems and the selling begets more selling. But in the absence of fiat money a liquidity crisis would be impossible.

A liquidity crisis is not a business slow down or recession. This is where an over expansion has taken place by businesses and they now have to cut back and downsize.

The boom and bust economic cycle is also caused by an artificial expansion of money and/or excessive credit expansion. Fiat money causes this event also, but this is not a liquidity crisis. This is part of the business cycle which is caused by investment and overexpansion of plant and equipment by businesses usually induced by fiat money being pumped into an economic system but this is not a liquidity crisis.

The liquidity crisis relates to all of the above economic events but is unique in its short term and long term effects on real and financial asset values.

In 2006 and 2007 when the real estate markets in the U.S. and Europe started to top out there was no recession and no general business slowdown. But a liquidity crisis was born and became acute in 2008.

The Gerbino Principle Explained

With a paper or fiat money system, the more money that is injected into an economic system the higher the eventual price of consumer goods (inflation) and during this time the higher the prices of real estate and stock values – both values also responding to the new circulating money supply. More debt is also created (taken on by people, institutions and governments). If the money supply goes up by 5% consumer goods will go up by 5%, also increasing the prices of other assets like real estate and stock prices usually by 5%. Sometimes these real and financial assets increase even more as the increased money and credit create abnormal speculation.

It is counter-intuitive that more money would create less liquidity and this is why this concept has remained hidden from economic thinking in the past and in the modern era.

How the Principle Works

The new money drives up the prices of financial and real assets at somewhat the same rate of increase as consumer goods but since these financial assets have so much more market value to begin with, the per cent rate is not the key, it is the increase in the monetary value that is the key. Let me explain.

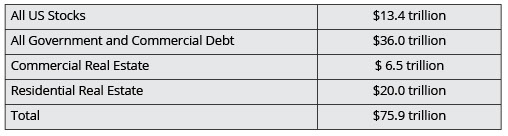

In the United States the values of the four main financial and real asset classes are as follows:

This huge monetary value of asset classes is supported by the circulation of only $1.9 trillion of the current U.S. money supply, M1 (cash plus checkable deposits). The ratio of these asset values to real liquidity (cash plus checking accounts) is basically 40 to 1. So if confidence is lost in the economy, financial structure or banking system and too many people who own these assets want to “lighten up” and “get liquid” there is literally not enough money to satisfy this desire.

You cannot fit $76 trillion of assets into a $1.9 trillion bottle

In a panic mode, this leverage of asset values to actual money available creates a crisis of liquidity. This in turn acts to create a downward spiral of prices from the liquidations (selling) and brings on more panic as balance sheets deteriorate and margin calls become the order of the day on Wall Street.

The increase of fiat money has distorted the ratio of money in circulation to asset values. This distortion becomes the Achilles Heel of asset values when confidence is lessened or severely impacted by economic or political reasons.

If there are more sellers than buyers of any asset class, even as little as 1-2% more sellers who are determined to “get out”, then as long as this small but determined group persists to sell an asset the further prices will erode. Eroding prices also begets more sellers and this continues until the sellers who want to cash out are satisfied or the asset prices become so low that new buyers come into the market and absorb the selling pressure with buying pressure, stabilizing the asset price.

As more money is created to handle a liquidity crisis (bailing out the politically connected as in 2008-2011), it sows the seeds for the next crisis as the new liquidity eventually pushes up prices of financial and real assets to a level that again cannot be sustained when for some future reason general business or economic confidence is lessened and another panic ensues. These panics can start from many causes:

- Loss of confidence in economic expansion and a fear of recession.

- Political mismanagement of economies.

- Inflation rates that are higher than expected and increasing, causing the liquidation of stocks and bonds.

- Large bankruptcies from overleveraged financial institutions as in 2008.

- Excessive speculation in asset classes like residential real estate in the decade leading up to 2006.

- International events like an oil embargo or major war.

When Times Were Better

In 1960, the United States had a more stable monetary system with much less currency debasement. The prior 10 years saw a relatively modest increase by today’s standards of 26%.

The value of stocks, government and commercial debt and residential real estate was only $1.7 trillion in 1960, and the money supply (M1) was $144 billion. This was only a 11.8 to 1 ratio of liquidity to these assets compared to a 40 to 1 ratio today.

Note: I have left out of this 1960 example, commercial real estate as it is the smallest component of the four major categories discussed earlier, as this value was impossible to verify in the 1960 period.

Since 1960 a 1,250% increase in money supply (1960 - 2011) has created an almost 4,000% increase in asset values. It proves the point that creating more money has allowed for a somewhat manageable ratio of liquidity to asset values of approx. 1 to 12 that persisted in 1960 to an untenable ratio of 1 to 39 today (note again that 1960 commercial real estate values are left out of this example).

The Late 50’s and early 60’s were pretty good times in America. Families were prospering, savings rates were up, new cars were affordable every 3-4 years, middle class wage earners could actually send their kids to college. A household with two working parents was the exception. Money and wages bought you a lot of goods and services.

One of the key distortions of fiat money is that it robs the purchasing power of the lower and middle income earners. Since 1960, teachers (a typical middle income earner) salaries have increased 9.7 times, but home values (even today) are still up 21 times. One can almost find any good or service and it will also be up 20-30 times.

Who is to Blame?

It’s a simple list; Liberals and Conservatives, Republicans and Democrats. They have all been duped by the banking elites and Keynesian economists.

Do Not be Scared of the Future

It is important to remember that money does circulate and sometimes in much greater amounts than the overall value of the money supply. In other words there could be $10 trillion of financial transactions in one week with only $1 trillion in money available. These liquidity crises are actually rare but will become more prevalent as more fiat money is created because the increase of the asset values far outpace the underlying per cent increase of the money supply.

Investor A, panicking out of IBM, for instance, and dumping the stock at any price, will end up with cash in his/her account. But that money will most likely go into a money market fund or be invested in U.S. Treasuries or a corporate bond. It will not sit there. Someone else who sells the Treasuries or the corporate bond to Investor A will now have that cash and now in turn can go and buy some other assets, maybe even IBM if he/she feels the price is right.

If Investor A’s cash from selling IBM is placed in a money market account, these funds in turn will be invested or lent to various institutions by the money market managers to earn an interest rate on the capital in the fund. If an Investor buys US Treasuries directly from the U.S. Treasury it will be spent by Uncle Sam and put into the system by government expenditure.

It is because of the money supply circulating in an economic system that some equilibrium of asset prices can usually be maintained. Selling by Joe is met by buying by Tom. Historically this has worked to restore prices to an economic equilibrium but with a cash to asset value ratio bloated by fiat money the equilibrium becomes distorted dramatically and invites a major sell off when confidence in the value of asset prices becomes widespread or a panic starts. Then a liquidity crisis develops.

At this time I would like to add that an equilibrium point in the value of an asset or asset class is reached when buyers and sellers are satisfied and most likely the return on the asset (rent, interest, dividends) is reasonably compared to the world one lives in. In other words, a condo valued at $200,000 that can’t be rented for even a 1% return is probably overpriced. Subjective and logical reasoning based on everyday life experiences and choices by buyers and sellers will eventually arrive at an equilibrium value in a normal economic environment. But in a liquidity crisis these values can be distorted dramatically.

Fiat Money A Bad Solution For Investors

With a cash to asset value ratio bloated by fiat money the equilibrium becomes dramatically distorted and invites a major sell off when confidence in the value of asset prices becomes widespread or a panic starts. Then a liquidity crisis develops. The start of the liquidity crisis can be caused by many factors but the underlying reason it persists is caused by fiat money.

The more money that is created the more ballooned are the values of various investment asset classes. A relatively small per cent increase in money supply can increase the value of these mentioned financial and real assets well beyond the increased per cent of the money supply.

A 5% increase to a money supply of $1.9 trillion is $95 billion more in circulation. As that $95 billion circulates within the economy it will eventually raise consumer prices by 5%, but it will also raise the value of real and financial assets. This 5% increase applied to the above $76 trillion of asset values (including commercial real estate) mentioned earlier can become $3.8 trillion (5% of $76 trillion) of increased asset values.

The arbitrary and artificial increase in the money supply creates a never ending problem of asset values expanding and then collapsing. Too much money creates too little liquidity when there is a loss of confidence in financial assets.

Today these asset classes, except real estate, are now more susceptible to a panic or asset sell off or another liquidity crisis. Real estate has been so battered because of the illiquidity of the sector to begin with coupled with the liquidity crisis of 2008 and beyond, that it may be close to an equilibrium level.

The fiat money system that creates liquidity crises also destroys purchasing power of the lower and middle class. No where is this more pronounced than the last 50 years. In 1960 typical middle income wage earners were school teachers. Their salaries in 1960 were $5,175. The average home in 1960 was $12,700. Since then school teacher salaries have gone up approx. 10 times. But the average home price, even after the sell offs of the last few years, as of last month have increased 21 times. Fiat money has destroyed the purchasing power of the average American.

This Principle of Liquidity also is another reason why gold is going up, as it is the ultimate liquid financial or monetary asset. If one wants liquidity with no strings attached, gold is it. The asset class that will be left standing in any crisis will be precious metals - gold and silver.

The Mini Liquidity Crunch in the Precious Metal Mining Stocks

I believe the gold and silver mining stocks which are presently very undervalued against the high prices of gold and silver are currently experiencing a mini liquidity crunch (a distant cousin of a crisis) within the realm of gold and silver mining investors.

These investors have only so much inclination and money at their disposal to buy these mining stocks. But the supply of new mining deals, IPO’s, new financings and private placements have stretched and somewhat overwhelmed the buying power of this relatively small group of international players (individual investors and institutions with an appetite for mining stocks).

An exhaustion of capital allocated to this sector by these players has occurred and has also been diluted further because of the newly created family of associated asset classes like uranium, base metal and rare earth companies. It is simply a matter of a limited amount of money and too many companies. Until more players (and capital) come forth on this stage, this sector could languish at what appears to be excellent and undervalued stock prices. Only the best growth and value mining stories will do well until new players arrive with more capital to invest.

This Principle may also explain why U.S. Treasuries (1-5 year paper) is relatively very strong while it is paying so little interest. It could be because buyers of these bills and bonds can rely on being able to cash them in at a fixed value at maturity as opposed to not knowing what the price of IBM or a duplex apartment will be worth in another full scale crisis or sell off.

The Next Crisis

What will cause the next liquidity crisis is unknown, but the U.S. and Europe are being set up for one to occur because of the continued reliance of fiat money to bail out debtors, the banking system, and government deficits.

German, French and British banks have $1 trillion of exposure to Portugal, Ireland, Greece and Spain, the so-called PIGS. A large per cent of these loans are suspect and due to this a race to liquidity in Europe could start at any time.

After the 2008 crisis another stock market rally occurred, 2009-2011. This was because massive amounts of fiat money were injected into the U.S. economy by the Fed. From January 2008 to May 2011, the U.S. money supply has seen the greatest short-term increase in history, 41%.

Because of this, financial assets again will rise and eventually real estate will also rise probably very slowly (based more on supply and demand as opposed to the rampant speculation of the last pre-2008 decade).

Final Thoughts

The lesson to be learned is that the more money created the more severe the next liquidity crisis will be and that the more money created the less liquidity there will be for financial and real assets to withstand any sort of liquidation panic as the extra money cannot come close to the asset monetary value created by the circulation of that extra fiat money. This is the Gerbino Principle of Liquidity.

This phenomenon has been in plain sight for decades and our good friend Sir Arthur Conan Doyle said it best....

“There is nothing more elusive than an obvious fact.” — Sherlock Holmes.

These liquidity crises are disruptive and dangerous and are caused solely by fiat money which has caused major distortions in modern economies. End fiat money creation and you will end future liquidity crises that disrupt and cause havoc to modern economies.

Kenneth J. Gerbino

Kenneth J. Gerbino

& Company

Investment Management

9595 Wilshire Boulevard

Suite 303

Beverly Hills, CA 90212

Phone: (310) 550-6304

Fax: (310) 550-0814

Kenneth J. Gerbino & Company

Investment Management

9595 Wilshire Boulevard, Suite 303

Beverly Hills, California 90212

(310) 550-6304

Copyright 2004-2018 Kenneth J. Gerbino & Company. All Rights Reserved. KENNETH J. GERBINO & COMPANY and its logo are trademarks and service marks owned by Kenneth J. Gerbino & Company. Site design and maintenance by www.DesignStrategies.com.